Think about the last big decision you made. Maybe it was a career move, an investment, or even a tough personal choice. Now, picture a professional poker player staring down a massive pot, their tournament life on the line. Honestly, the processes aren’t that different. Both scenarios are high-stakes, riddled with incomplete information, and require a cool head to navigate human psychology.

That’s where the magic happens—where the gritty, felt-table reality of poker collides with the academic insights of behavioral economics. This isn’t just about cards or chips. It’s a masterclass in decision-making under pressure, a framework for understanding why we so often trip over our own mental shortcuts.

Your Brain at the Table: The Hidden Biases in Every Hand

Behavioral economics tells us we’re not the rational, Spock-like actors classical models assume. We’re messy, emotional, and predictably irrational. Poker, well, it puts those flaws under a blinding spotlight. Let’s dive into a few of the big ones.

Sunk Cost Fallacy: The “I’ve Come This Far” Trap

In economics, a sunk cost is a past expense you can’t recover. And the fallacy is throwing good money after bad just because you’re already invested. In poker? It’s calling off your last chips on a terrible hand because you’ve already put so much into the pot. You’re not playing the current odds; you’re playing your past commitment.

Sound familiar? It’s the failing project you keep funding, the bad relationship you stay in because of “all the time you’ve put in.” Poker players learn to ignore the sunk cost—the money in the middle isn’t theirs anymore. It’s just a resource in the pot. Detaching from past investments is a brutal but essential skill for clear-eyed choices.

Resulting: Judging a Decision by Its Outcome

Here’s a classic poker scenario. You have a strong hand and make a mathematically perfect, aggressive bet. Your opponent, against all odds, catches one perfect card on the river to beat you. If you think, “My bet was a mistake,” you’re resulting.

You’re confusing the quality of the decision with the randomness of the outcome. The world is noisy. Good decisions can lose, and bad ones can win—in the short term. The key is to build a process robust enough to succeed over time, despite the unpredictable outcomes. It’s the core of separating skill from luck, whether you’re analyzing a stock pick or a strategic business move.

Mental Models from the Felt for Everyday Life

So, how do poker pros combat these innate biases? They develop frameworks—mental models—that anyone can borrow.

Expected Value (EV): Thinking in Probabilities, Not Certainties

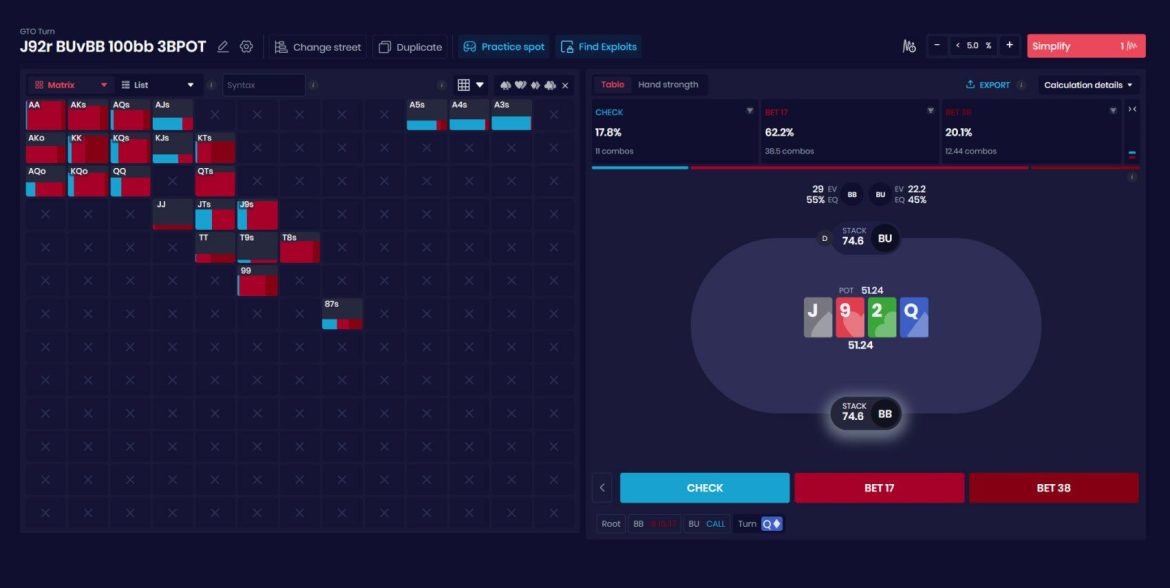

Every poker decision is framed around Expected Value. It’s a cold, calculated average of all possible outcomes, weighted by their probability. A +EV move makes money in the long run, even if this specific instance fails.

The translation? Stop asking “Can I win?” or “Will this work?” Start asking: “If I make this same decision 100 times, what’s the net result?” It shifts you from binary, fear-based thinking (“win/lose”) to probabilistic, long-term thinking. Launching a new product feature? Some will flop. But if the strategy is +EV across the portfolio, you’re winning.

Range Thinking: See the World in Spectrums

Amateurs put an opponent on one specific hand. “He has aces!” Pros think in ranges—the entire spectrum of hands someone could have based on their actions. This is a profound shift from certainty to ambiguity.

In negotiations, don’t fixate on the other side’s single, hidden motive. Consider their range of possible motivations, pressures, and options. It keeps you flexible, responsive, and less likely to be blindsided. You’re no longer playing checkers; you’re playing a multidimensional game of incomplete information.

The Emotional Toolkit: Tilt, Ego, and Awareness

All the theory in the world crumbles if you can’t manage your state of mind. Poker players call it “tilt”—the emotional frustration that leads to catastrophic, revenge-driven play. Behavioral economics studies it as the hot-cold empathy gap or affect heuristic, where intense emotions hijack our decision-making apparatus.

- Ego is the Enemy: The need to be “right” or prove you’re the smartest person at the table is a massive leak. It leads to stubbornly sticking to a failing plan. Good players have no ego about a specific hand; they just want their decisions to be profitable over time.

- Meta-Cognition is Key: The best players are constantly aware of their own mental state. “Am I tired? Am I frustrated because of that last bad beat? Is my focus slipping?” This ability to observe your own thinking—to be a spectator to your own mind—is maybe the ultimate decision-making hack.

Putting It Into Play: A Quick Decision Audit

You don’t need to play poker to use this. Next time you’re facing a complex decision, run a quick mental audit. Ask yourself:

| Poker Concept | Your Decision Audit Question |

|---|---|

| Sunk Cost Fallacy | If I weren’t already invested in this path, would I start it now? |

| Expected Value (EV) | What’s the probability-weighted average outcome if I make this choice repeatedly? |

| Resulting | Am I judging my past choice based on a good/bad outcome, or on the information I had at the time? |

| Emotional State (Tilt) | Is fear, excitement, or frustration driving this, or is it logic and probability? |

It’s not a perfect system. Nothing is when humans are involved. But it builds a layer of insulation between the chaos of the moment and the choice you finally make.

In the end, poker and behavioral economics teach the same humbling lesson: the opponent you must understand most isn’t across the table, or in the market, or on the other side of a negotiation. It’s the one inside your own head, wired with ancient biases and emotional triggers. Mastering decision-making isn’t about eliminating emotion or uncertainty—that’s impossible. It’s about building a better, more aware process to navigate through it all. To make peace with the fact that you can do everything right and still lose the hand… and that the only thing that truly matters is being brave enough to make the same good bet again when the next opportunity comes around.